[Eco] How do you calculate aggregate demand and supply? Class 12

In classical economics, saving was an increasing function of the rate of interest. Investment was a decreasing function of the interest rate. Together the saving and investment functions gave the equilibrium level of saving (equal to capital formation) and the rate of interest. John Maynard Keynes's General Theory changed this.

Class 12th Saving Function Economics Tutorials Point YouTube

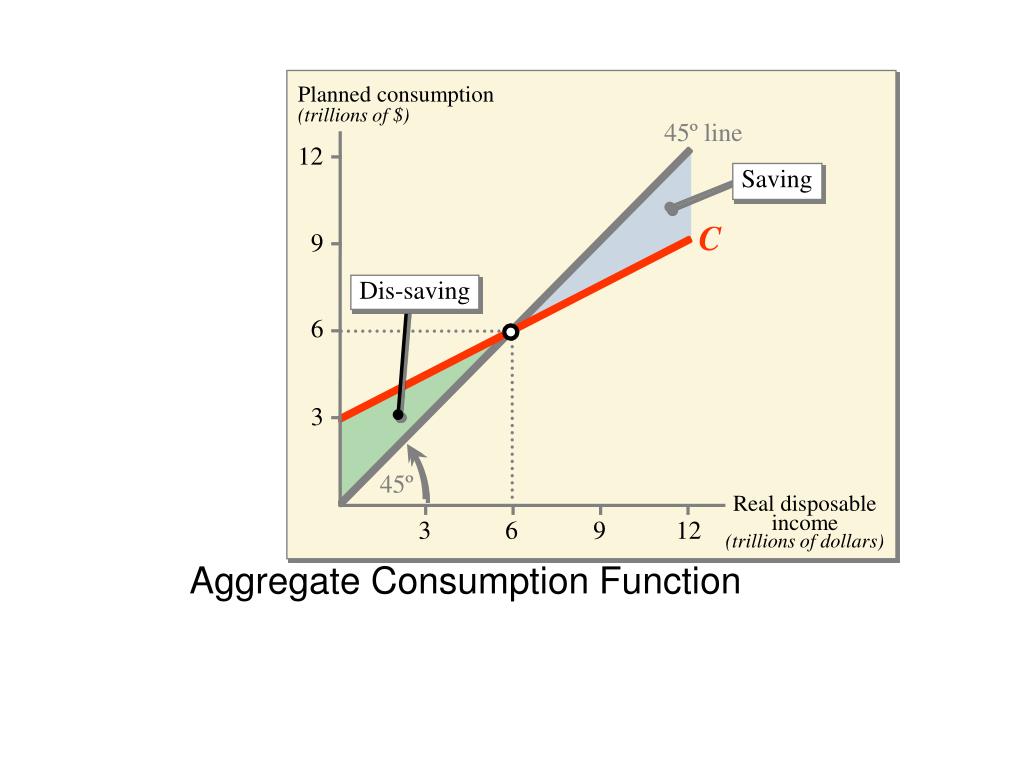

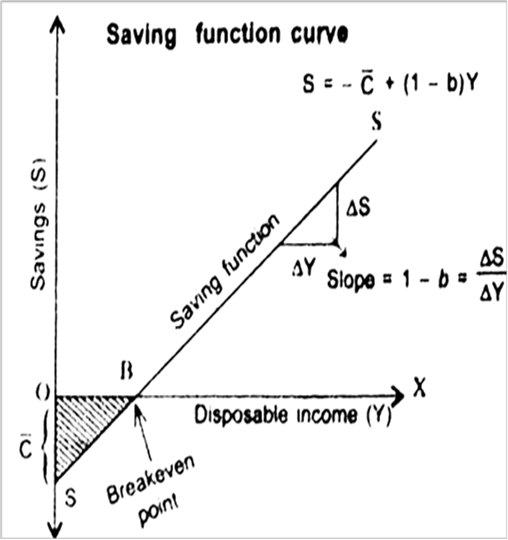

Meaning of Saving Function: Cons umption increases as income increases but less than the rise in income. We will now explain what happens to saving when income increases. Saving is defined as the part of income which is not consumed because disposable income is either consumed or saved. Thus, ADVERTISEMENTS: Y = C + S S = Y - C

Consumption and Saving

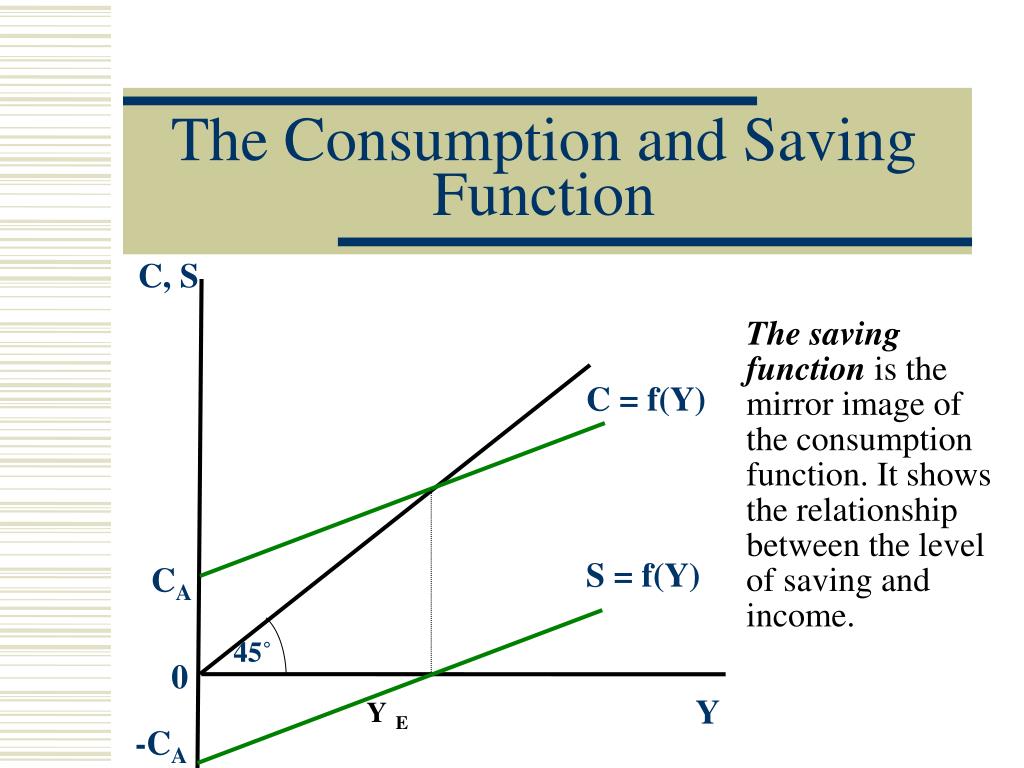

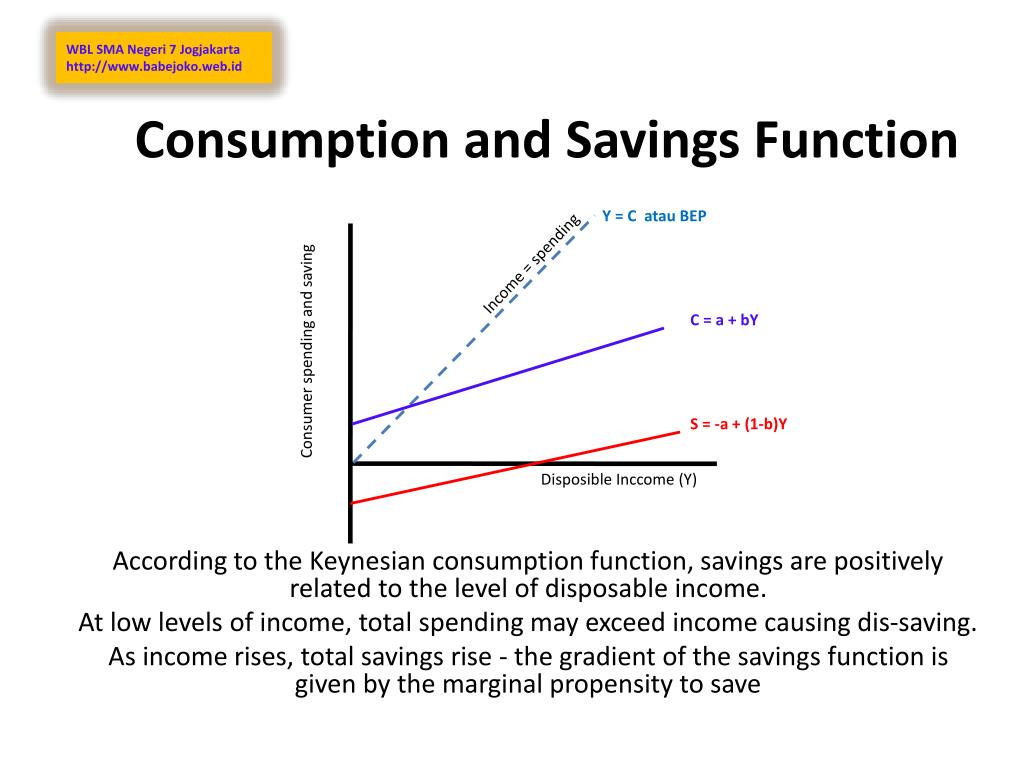

The savings function has a negative intercept because when income is zero, the household will dissave. The savings function has a positive slope because the marginal propensity to save is positive. When disposable income increases, consumption also increases but by a smaller amount.

Derivation of Saving Function curve from consumption function curve and vice versa YouTube

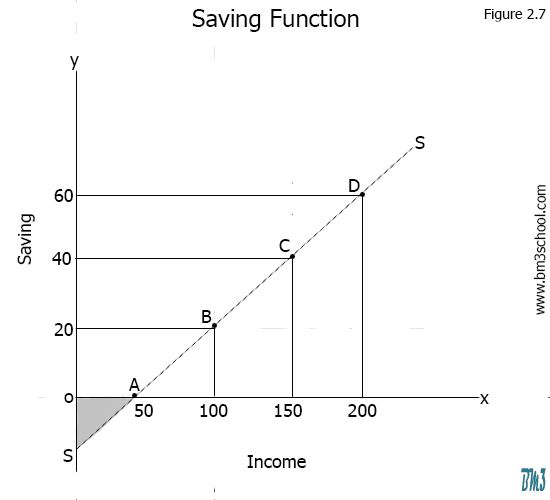

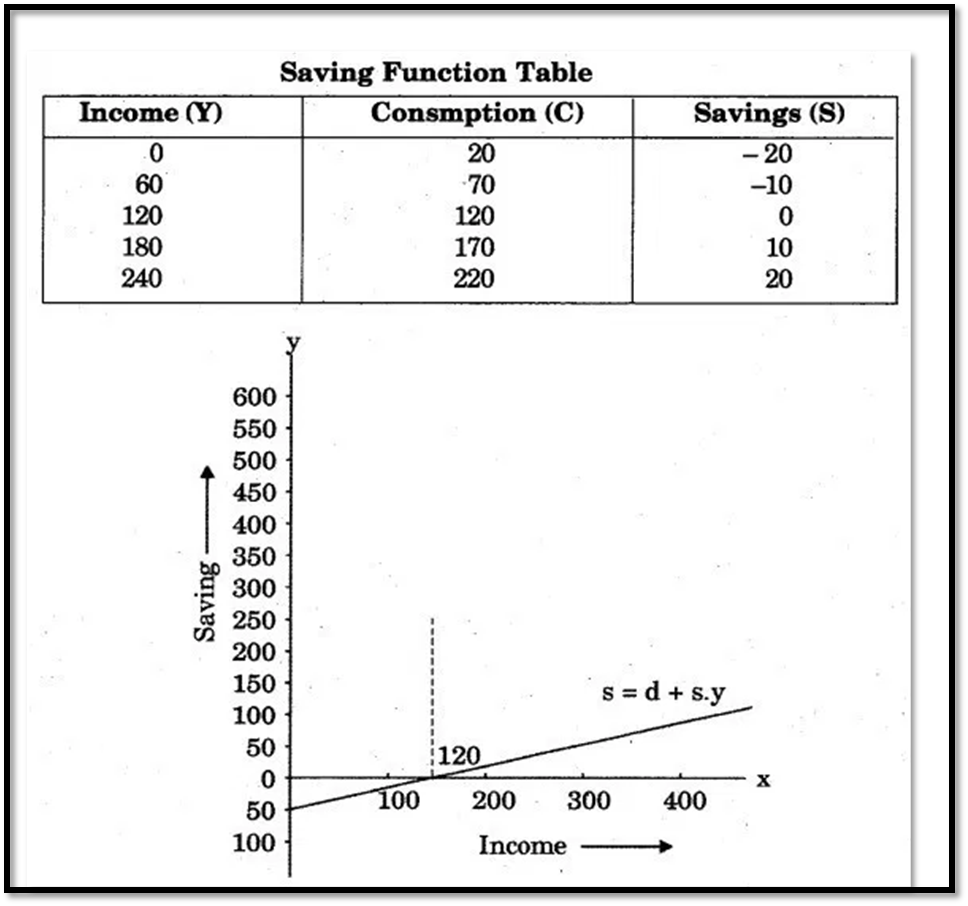

Saving function is also known as Propensity to Save and is represented by S = f (Y); where S = Saving, Y = National Income, and f = Functional Relationship. Let's understand the concept of Saving Function with the help of the following saving schedule and saving curve. Saving Schedule: The above schedule shows saving at different income levels.

🎯Saving Function & Propensity to Save APS & MPS Part3 Macro Economics YouTube

Income that consumers earn but do not spend on consumption will be saved in some form. Y = C + S If the consumption function is C = a + bYd Then the savings function is given by: S = -a + (1-b) Yd With zero income consumers still spend the amount "a"; this means they dissave "a".

4th Year Economics Saving Function YouTube

Saving function a = autonomous consumption. In this case -a = autonomous saving. At zero income, households borrow to afford the basic necessities of life. MPS = slope of the savings function. In this case it is -1 + (1-b)Y How to calculate the MPS If the change in income = 8% and saving rises 2%. The MPS = 0.25

Explain Saving Function with Schedule and Diagram Bm3schools Business Management Study

Saving is income not spent, or deferred consumption.In economics, a broader definition is any income not used for immediate consumption.Saving also involves reducing expenditures, such as recurring costs.. Methods of saving include putting money in, for example, a deposit account, a pension account, an investment fund, or kept as cash. In terms of personal finance, saving generally specifies.

PPT Consumption, Saving s and Investment PowerPoint Presentation, free download ID5644488

Saving function or the propensity to save expresses the relationship between saving and the level of income. It is simply the desire of the households to hoard a part of their total disposable income. Symbolically, the functional relation between saving and income can be defined as S= f (Y). We know, Y= C + S; Thus, S= Y-C;

The equilibrium between the savings function curve and the investment... Download Scientific

FIG. 2.1A R. G. D. Allen, Macro-Economic Theory R. G. D. Allen 1967 usually we fix prices and the flow is in real terms, e.g. in terms of the consumption good, or in aggregates at fixed (base) prices. We ignore at present the fact that savers and investors need not be the same people, so complicating the flow from income to demand.

PPT Keynes and the Evolution of Macroeconomics PowerPoint Presentation ID413109

The Gold Standard. The Bretton Woods System. Classical Model and Keynesian Model. Monetarist Model. Quantity Theory of Money. New Classical Model. Austrian Model. Learn The Saving Function with free step-by-step video explanations and practice problems by experienced tutors.

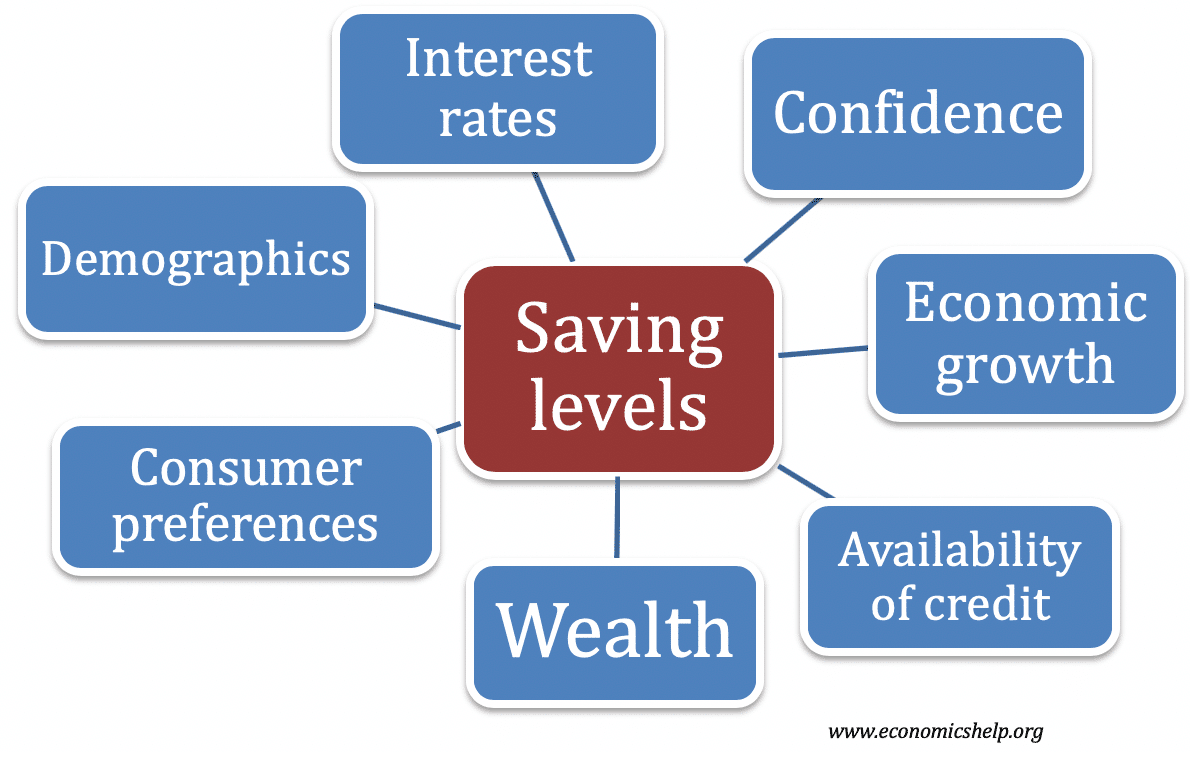

Factors that influence saving levels Economics Help

The saving function in economics arises from John Maynard Keynes' work on the consumption function, but it has limited practical use in the real world because it can only be used in simple economic models where we exclude government and foreign trade. For a fuller explanation of Keynes' model, see my main article at:

SAVING FUNCTION & NUMERICALS Notes NCERT Solutions for CBSE Class 12 Economics EduMple

This function captures the saving-income relation, the flip side of the consumption-income relation that forms one of the key building blocks for Keynesian economics. The two key parameters of the saving function are the intercept term, which indicates autonomous saving, and the slope, which is the marginal propensity to save and indicates.

PPT Consumption and Savings Function PowerPoint Presentation, free download ID2220549

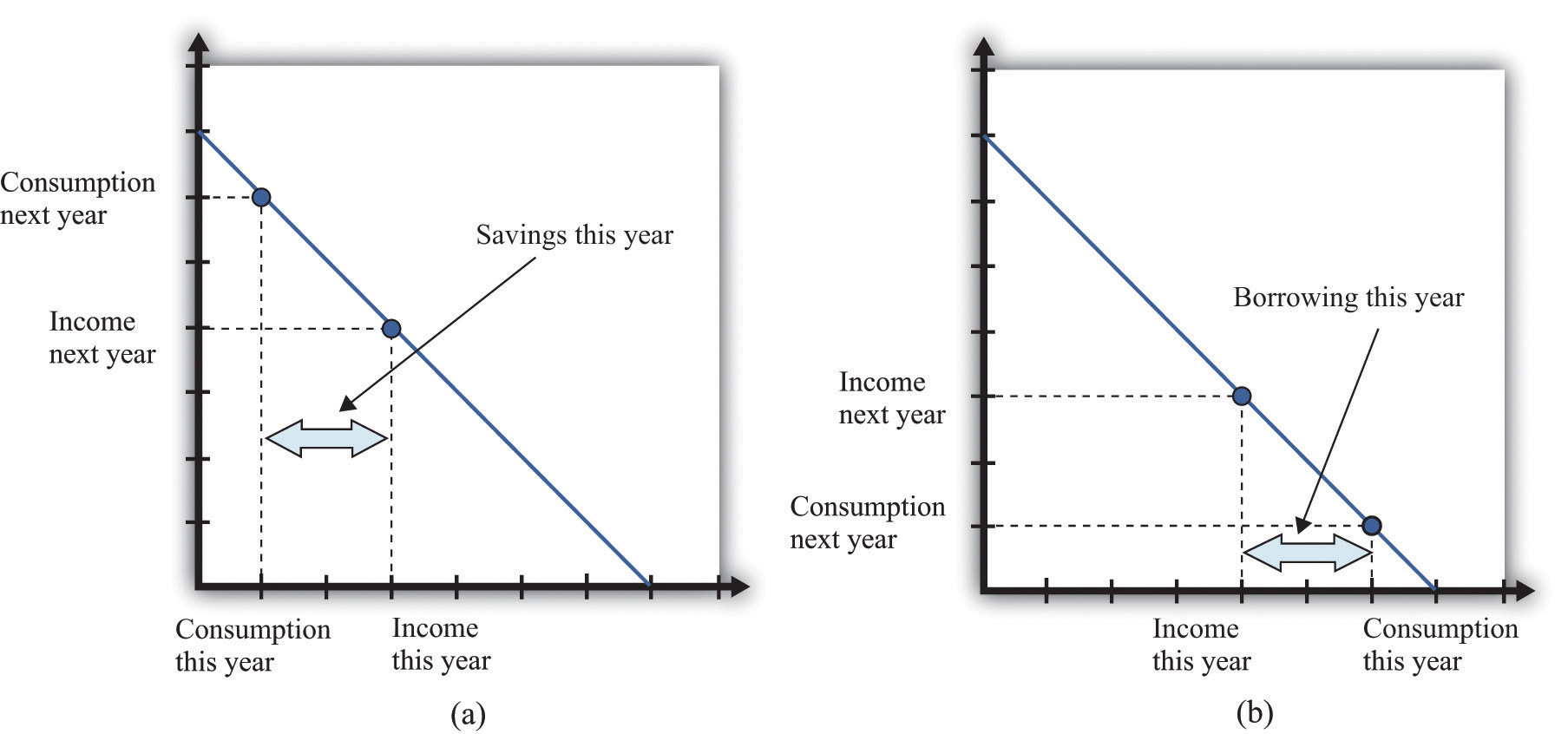

5 Conclusion. The cornerstone of Keynesian saving function is the relationship between consumption and income in the same period. Under the life cycle model and permanent income model, saving in any period is determined not by current level of income but by lifetime resources. Households save for various reasons including the inter-temporal.

Solved The saving function of an economy is shown. Dissaving

Saving is a withdrawal from the circular flow of income and it has a pivotal role in determining changes in national income over time. Decisions to save are affected by: Income In general, saving is a positive function of income - the greater the income the greater the likelihood of saving. Expectations

Saving function equation. How will you Derive the Saving Function from the Consumption Function

Saving Function Equation As in the case of a straight line consumption function, the straight line saving function can be described as a sum of saving at zero level of income (which is equal to intercept OS on the - Y-axis) plus the fraction of income saved (MPS) at a given positive level of income.

Neoclassical Growth Model Economics 428

Meaning of Saving Function: Saving is defined as the difference between disposable income and consumption: S= Y-C, where S is saving, Y is income and С is consumption. ADVERTISEMENTS: Thus the level of saving depends on the level of income. This is illustrated in Table 1.