LIC Jeevan Labh Policy Premium, Review & Benefits About Insurance

You can use this to calculate the LIC Jeevan Labh Plan-836 Maturity Value. The vested simple reversionary bonus rates are per 1,000 Sum Assured. In case you have a plan with Sum Assured of Rs. 5,00,000 - Use the values in the table as following: Bonus Value = Sum Assured / 1000 x Bonus Rate = 5,00,000 / 1,000 x Bonus Rate Simple Reversionary Bonus

lic jeevan labh plan 836 maturity calculator Talkaaj

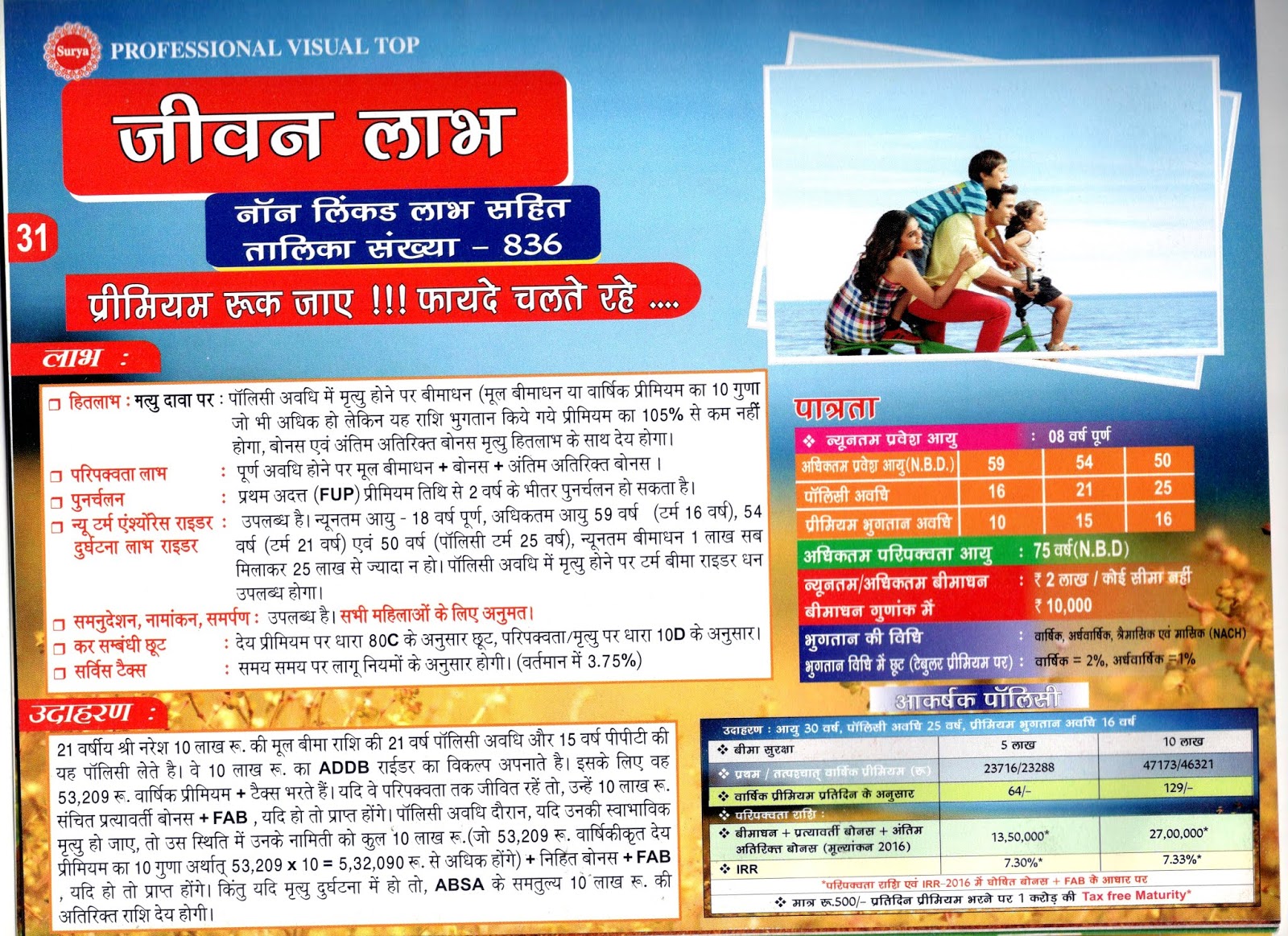

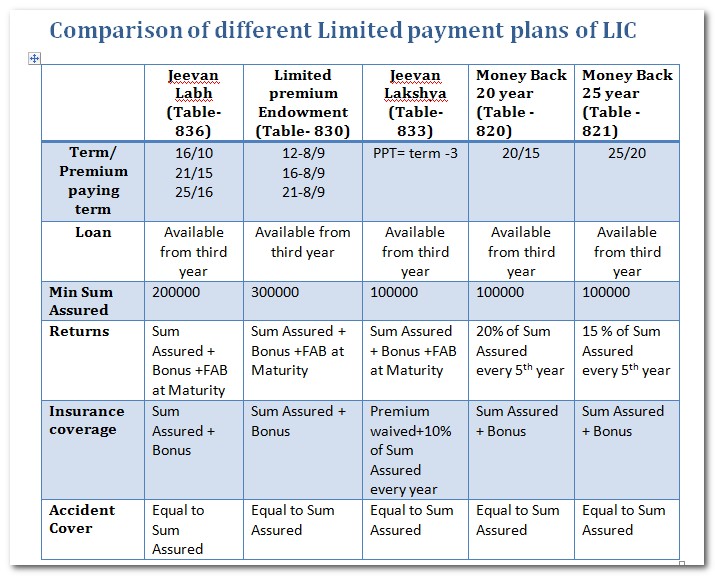

LIC Jeevan Labh - Plan 836 - All details with premium and maturity calculators. LIC's Jeevan Labh (T 836) is an endowment type of plan with limited premium payment period. It is one of the most popular insurance plans and is also considered as one of the best insurance policy from LIC of India.

LIC Jeevan Labh 836 All details with premium and maturity calculators Insurance Funda

LIC's Jeevan Labh Plan (836) is a limited premium paying, non-linked, with-profits Endowment Assurance plan. • Minimum Basic Sum Assured: Rs. 2,00,000/- • Maximum Basic Sum Assured: No Limit • Minimum Policy Term: 16 Year OR 21 Year OR 25 Year

125 LIC's Jeevan Labh, Yearly, Age Limit 859, LIC OF INDIA (DMKT) ID 22604394333

Using the LIC Jeevan Labh Calculator is simple and user-friendly. Here's a step-by-step guide on how to make the most of this tool: Step 1: Visit the official LIC website or use a trusted online insurance portal. Step 2: Locate the LIC Jeevan Labh Calculator on the website. Step 3: Fill in the required details, including the sum assured.

Lic Jeevan Labh Poster

Maturity Calculator for LIC Jeevan Labh (Plan No: 836) provides easy way to calculate maturity amount and illustrate Age-Wise and Year-Wise amount of risk covers. It uses Parameter like Bonus rate, Final Addition Bonus (FAB) etc which are similar to declared values, not exact and calculations are indicative only. Click here to know about this plan.

Jeevan Labh (836) Subhash Chand Life Insurance Advisor

LIC Jeevan Labh Plan (836) Loan Calculator provides ease to calculate year-wise loan amounts during policy term. Following table illustrates calculated loan for a policy with Sum Assured: 5,00,000, Policy Term: 22 Years and Yearly Premium: 24,010.

JEEVAN LABH Table No 836 New LIC Plan New LIC Plans Policies

LIC Jeevan Labh (Table No 836) is a non-linked (Not dependent on share market) limited premium paying endowment assurance plan which means premium paying term is less than policy term, for example, for 16 years policy term, premium needs to be paid for 10 years only and maturity will happen after completion of 16 years.

LIC?s Jeevan Labh Plan 836 Features and Benefits

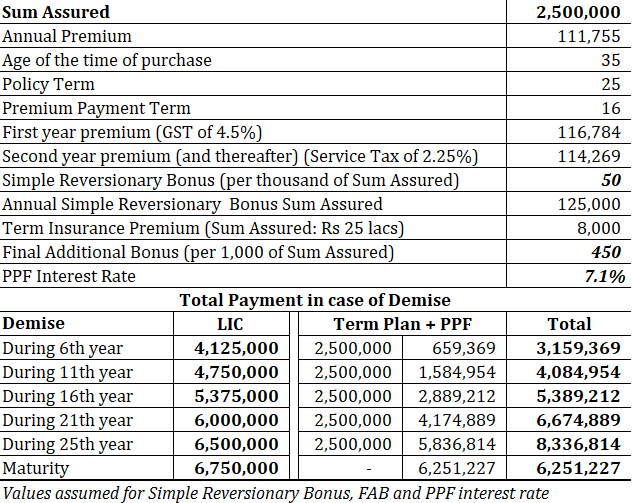

LIC Jeevan Labh Plan 836 Premium and Maturity calculator offers an easy way to calculate the total amount of premiums paid by the Investor. Plan 836 is an endowment policy introduced by LIC India on 1 January 2016.

lic jeevan labh (836 premium and maturity calculator) Archives

LIC Premium Calculator Jeevan Labh (Table-836) Following premiums are sample and calculated as per parameters given in first table. Please use above calculator to calculate premiums and benefits as per your AGE, TERM and SUM ASSURED (SA). Calculate premium maturity of jeevan labh plan with death claim detail. Premium with necessary riders and GST.

Jeevan Labh Plan (T936) LIC Agent Delhi

How the plan works: Step 1: Pick a premium amount to pay, depending on the coverage you require. Step 2: Choose a premium paying mode. Step 3: Pay regular premiums for the appropriate duration, based on the Sum Assured option chosen: - 10 years for a policy term of 16 years. - 15 years for a policy term of 21 years.

7+ Jeevan Labh 836 Maturity Calculator SaeidAraya

LIC Premium Calculator Jeevan Labh Plan (Table-936) Jeevan Labh modified plan (936) has premium paying term of 10, 16 and 16 years. Calculate Premium and maturity as per latest bonus rate. Jeevan Labh has accidental, term rider, premium waiver benefit. Calculate benefit with all riders.

LIC's New Plan Jeevan Labh (Table 836) Review, Benefit calculators, and comparisons. Our LIC

The Lic Jeevan Labh 836 Plan is a non-linked, limited premium endowment policy that provides both financial protection and savings benefits. It offers policyholders the opportunity to secure their family's future while building a corpus for various financial goals. Features of Lic Jeevan Labh 836 Plan

There is no LABH in LIC Jeevan Labh (Plan 936) My Blog

SRB for LIC Jeevan Labh 836 - paisa kaudi. Diamond Jubilee Bonus for LIC Jeevan Labh. LIC Declared this bonus on it's founding day. It's a one time bonus with some eligibility conditions. The prime condition is the plan should be active as on 1st Sep, 2016 also all the premiums should be paid till 1st Sep, 2016.

7+ Jeevan Labh 836 Maturity Calculator SaeidAraya

LIC Jeevan Labh 836 Premium and Maturity Calculator Highlights of LIC's Jeevan Labh 836 Please note that LIC Jeevan Labh 836 was withdrawn by the company; LIC has come up with an updated version of the same plan, LIC Jeevan Labh (Plan-936). The policy is a non-linked, endowment-based, limited premium paying insurance scheme.

LIC Jeevan Labh Plan 936 Benefits in Hindi एलआईसी जीवन लाभ योजना की पूरी जानकारी How to plan

For the current plan, here is my premium details as per policy document. Basic Premim - 14168 +GST 638Total Premium - 14806 Now NEXT DUE PREMIUM AMOUNT. Insurance21 Wrote : 26-01-2018 19:59:12. Currently, GST rate is 4.5% for first year premium and 2.25% for subsequent year premiums for jeevan labh plan.

125 LIC's Jeevan Labh, Yearly, Age Limit 859, LIC OF INDIA (DMKT) ID 22604394333

LIC's Jeevan Labh (836) is an Endowment type of plan, where the maturity amount is given as a single lump sum amount after completion of the term. Maturity amount of Jeevan Labh includes Sum Assured, Vested Bonus and Final Addition Bonus (if any).