ReadyToUse IRS Compliant Mileage Log Template 2022 MSOfficeGeek

IRS Compliant Mileage Log Last updated: Nov 3, 2023 When it comes to staying on top of your tax returns as a self-employed person or a small business owner, keeping adequate records of your mileage is paramount.

25 Printable IRS Mileage Tracking Templates GOFAR

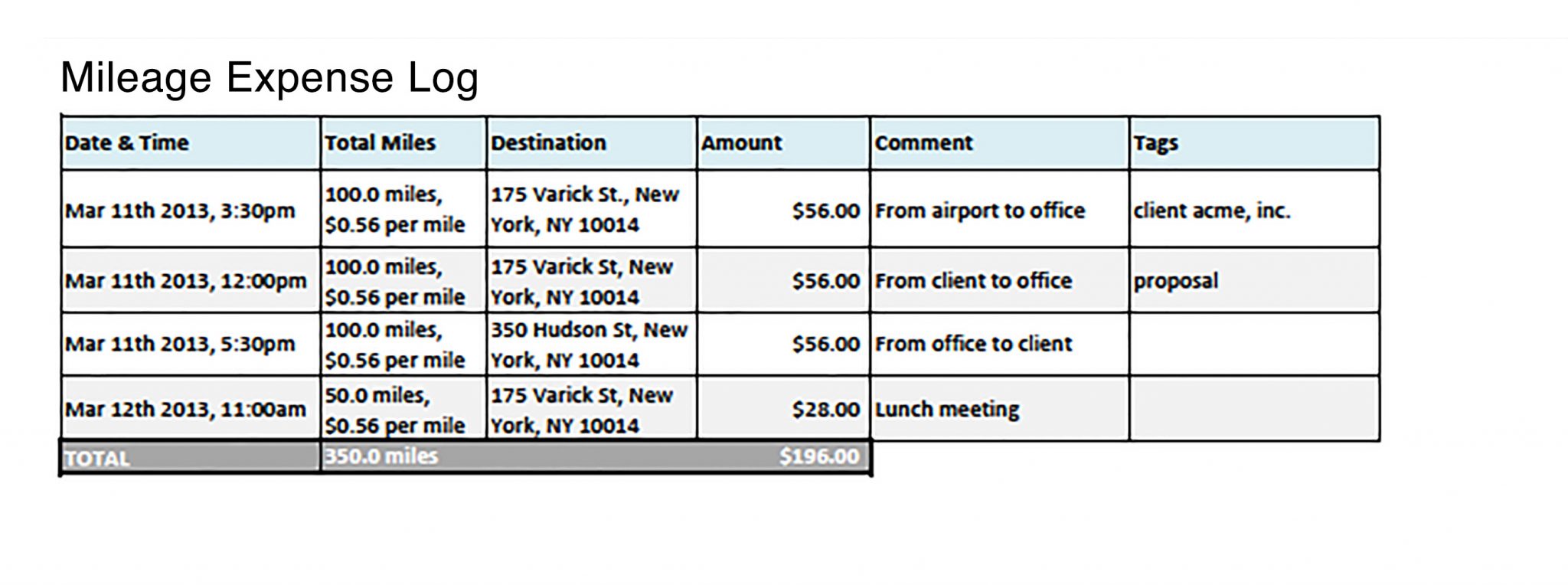

Automatically track mileage expenses and expenses, keep an odometer log, receipt vault and log billable hours. Quickly organize expenses by time period, project, or client.

25 Printable IRS Mileage Tracking Templates GOFAR

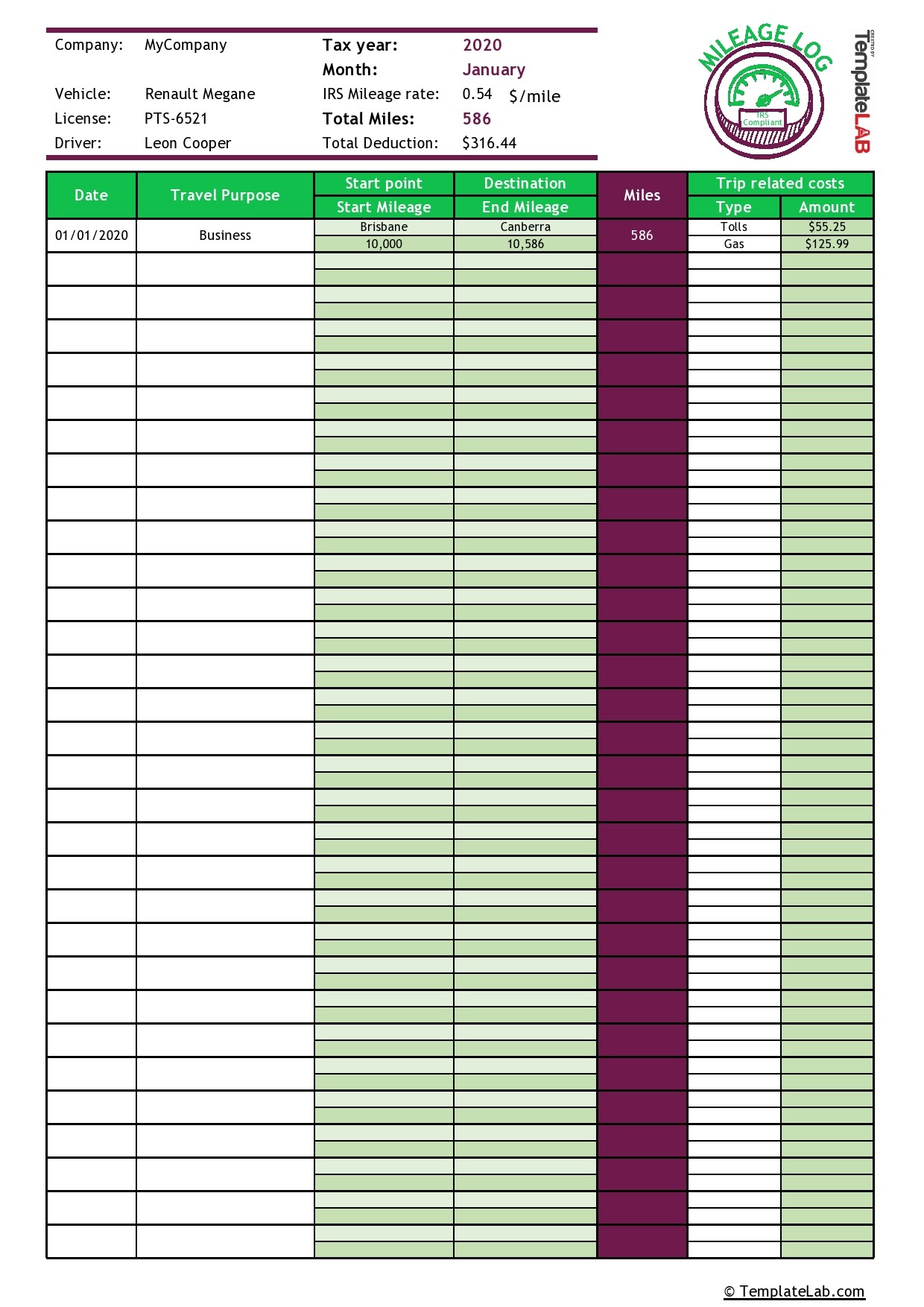

As of 2021, the standard mileage rate for vehicles is 56 cents per mile. Requirements for the Actual Expense Method Like the name implies, this method involves reporting all actual vehicle expenses to the IRS. Because the vehicle is used for business-related activities, a percentage of all maintenance done to it is eligible.

25 Printable IRS Mileage Tracking Templates GOFAR

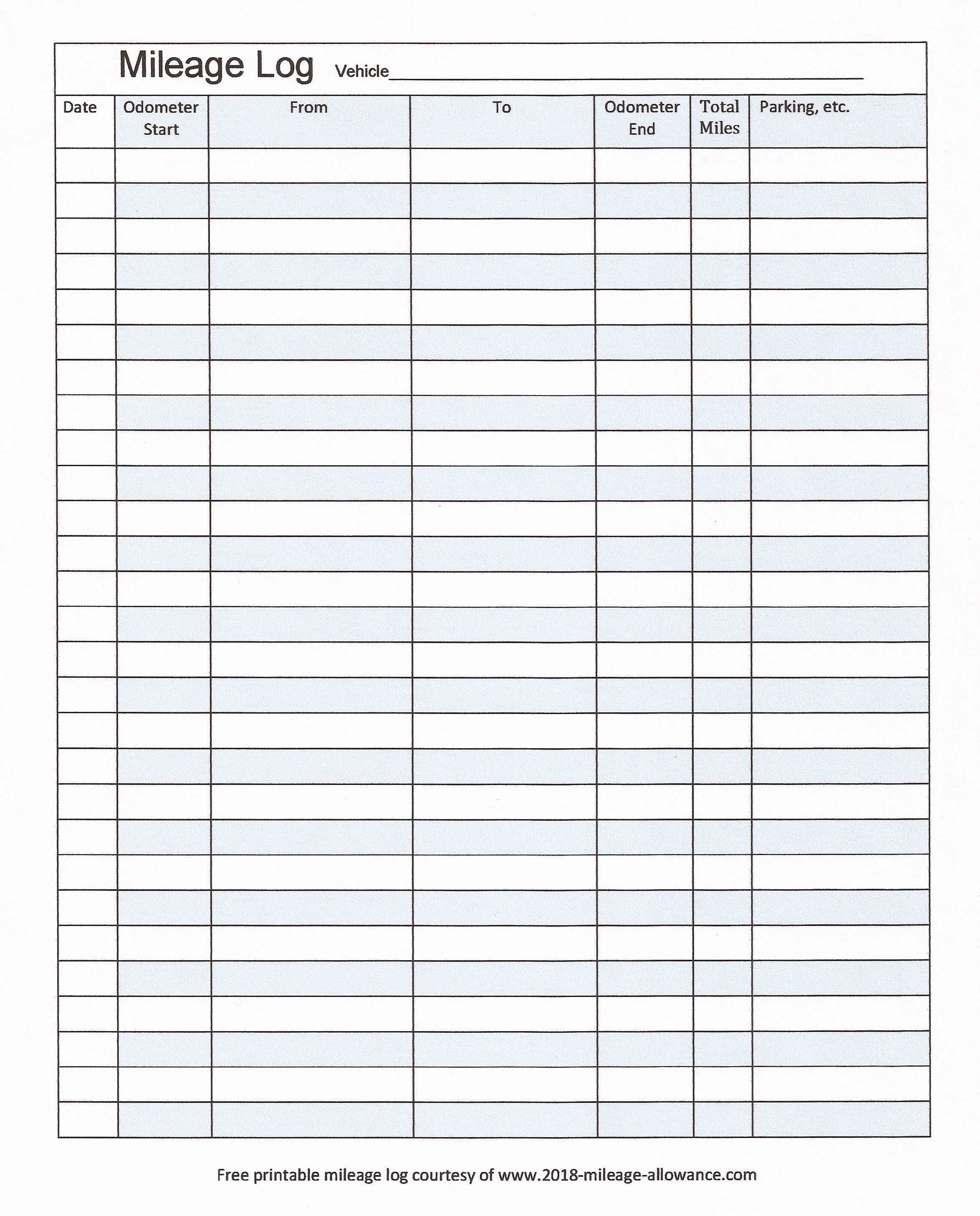

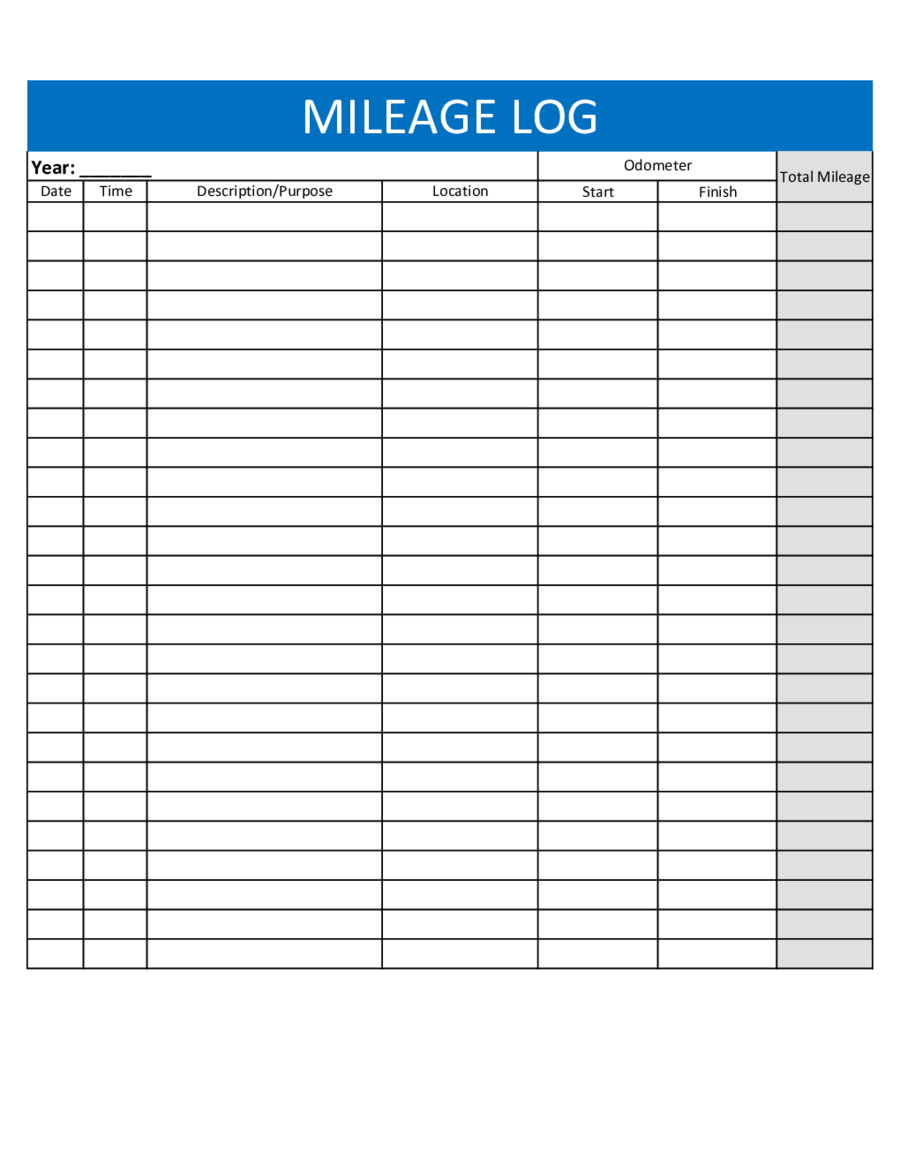

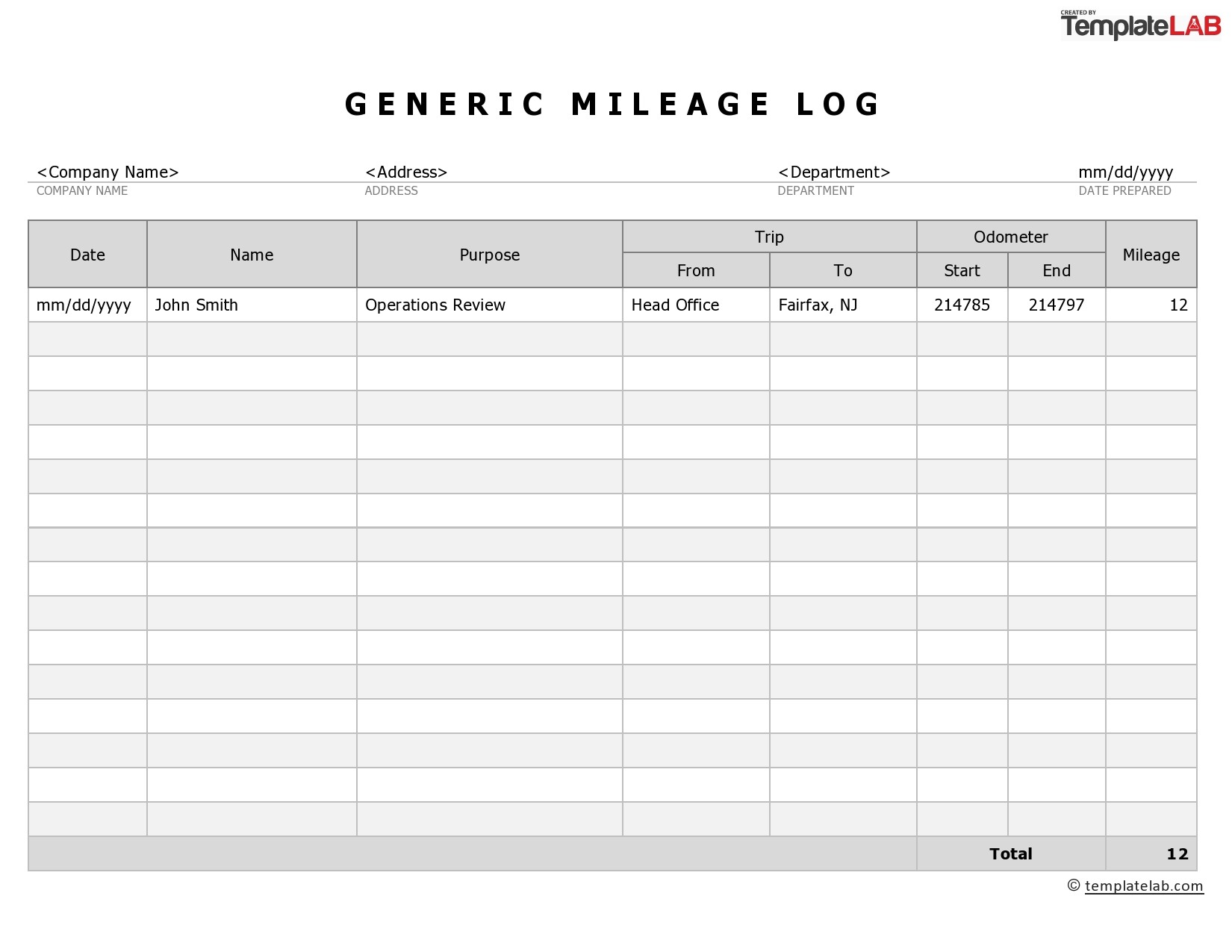

Track your miles manually with this downloadable, IRS compliant Excel mileage log template. Need more help with mileage tracking? Read on to get more tips.

Irs Mileage Log Template Fill Online, Printable, Fillable, Blank pdfFiller

The Key Elements of a Compliant Mileage Log for IRS Purposes What Counts? So what exactly is the IRS looking for from your mileage logs? First, let's figure out what kind of travel is actually eligible for reimbursement, and therefore necessary to log.

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

According to the IRS, keeping a mileage log book is the most effective way to ensure that you have proof in the event of an audit. What to record in your mileage log book Regardless of your employment situation, you will almost certainly have to keep track of the following: Total mileage for the year

IRS Compliant Mileage Expense Log > Falcon Expenses Blog

Standard Mileage Rate - For the standard mileage rate for the cost of operating your car for business, refer to Standard Mileage Rates or Publication 463, Travel, Entertainment, Gift, and Car Expenses. To use the standard mileage rate, you must own or lease the car and: You must not operate five or more cars at the same time, as in a fleet.

Irs Approved Mileage Log Printable Printable World Holiday

August 9, 2022 A mileage log for taxes can lead to large savings but what does the IRS require from your records? Follow these best practices to avoid an audit. Learn more! What are the IRS mileage log requirements? Your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense.

25 Printable IRS Mileage Tracking Templates GOFAR

An IRS-compliant log is more than just a record of distances; it's a comprehensive document that showcases the purpose and necessity of each trip. Let's break down the essential elements your mileage log should include to meet IRS standards. Critical Elements of an IRS Mileage Log:

25 Printable IRS Mileage Tracking Templates GOFAR

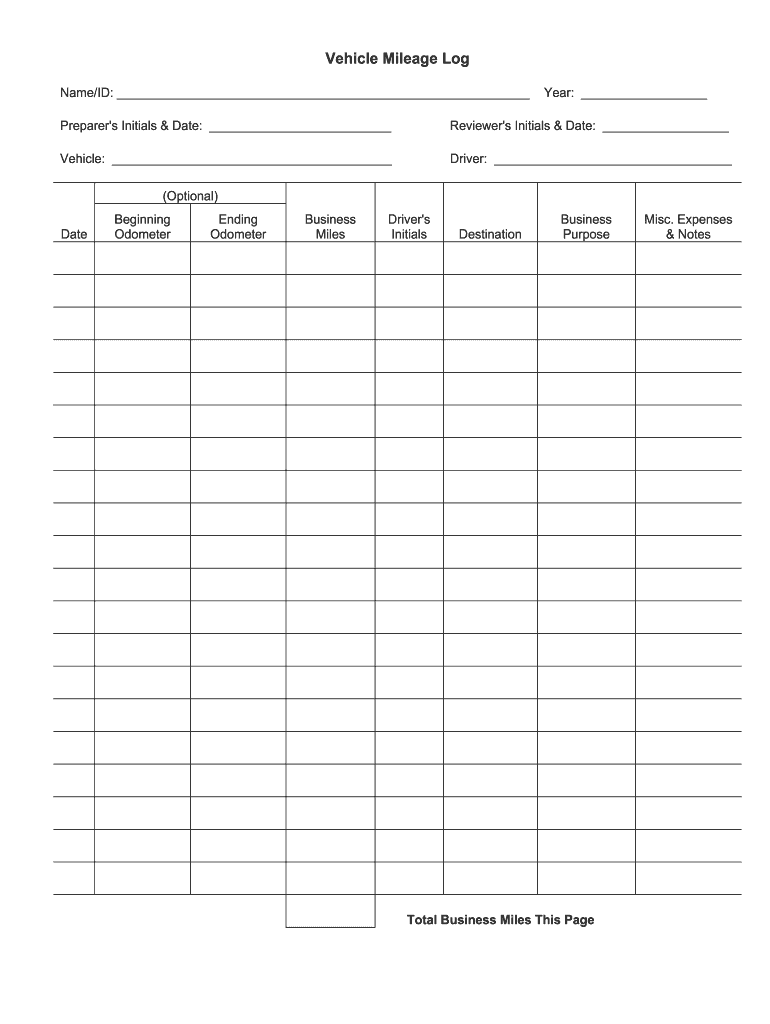

IRS approved mileage logs are required for each trip in a day. To meet the conditions, each log must include: Start and end location Date Miles Business purpose If any of those essential pieces are missing, the mileage log is not considered IRS compliant. Benefits of IRS Approved Mileage Logs There are considerable benefits to using IRS.

2023 Mileage Log Fillable, Printable PDF & Forms Handypdf

According to the IRS, you must include the following in your mileage log template: The mileage driven for each business-related trip The date of each trip The destination and purpose of your trip The total mileage you've driven for the year

Mileage Log for Taxes Requirements and Process Explained MileIQ

This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. It's user-friendly, compliant with IRS standards, and quite pretty to look at. All in all, it's a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Entering your trip details

25 Printable IRS Mileage Tracking Templates GOFAR

The 2023 federal IRS mileage rates are: 65.5 cents per mile for business purposes 22 cents per mile for medical and moving purposes (the latter is only for active military members) 14 cents per mile for charity purposes (this rate has been the same since 2011) How to stay compliant with IRS mileage deductions

ReadyToUse IRS Compliant Mileage Log Template 2021 MSOfficeGeek

The IRS accepts two forms of mileage log formats: paper logs and digital logs. Paper mileage log A paper log is a simple, written record of your business miles driven. It should include the date, the purpose of the trip, and the total miles driven for each business trip. Digital (electronic) mileage log

Irs Mileage Log Template BestTemplatess BestTemplatess

one of our free, printable, easy-to-use IRS compliant mileage tracking templates below to track your vehicle miles and work-related expenses manually. Major Pros and Cons of Different Mileage Tracking Methods METHOD PROS CONS Manual Logbook This old-fashioned pen-and-paper method is cheap.

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

The IRS defines adequate records for your mileage log Regardless of the circumstances of your employment, you will likely be asked to record the following: the mileage for each business use the total mileage for the year the time (date will do), place (your destination), and business purpose of each trip