Tax free shop osaka hires stock photography and images Alamy

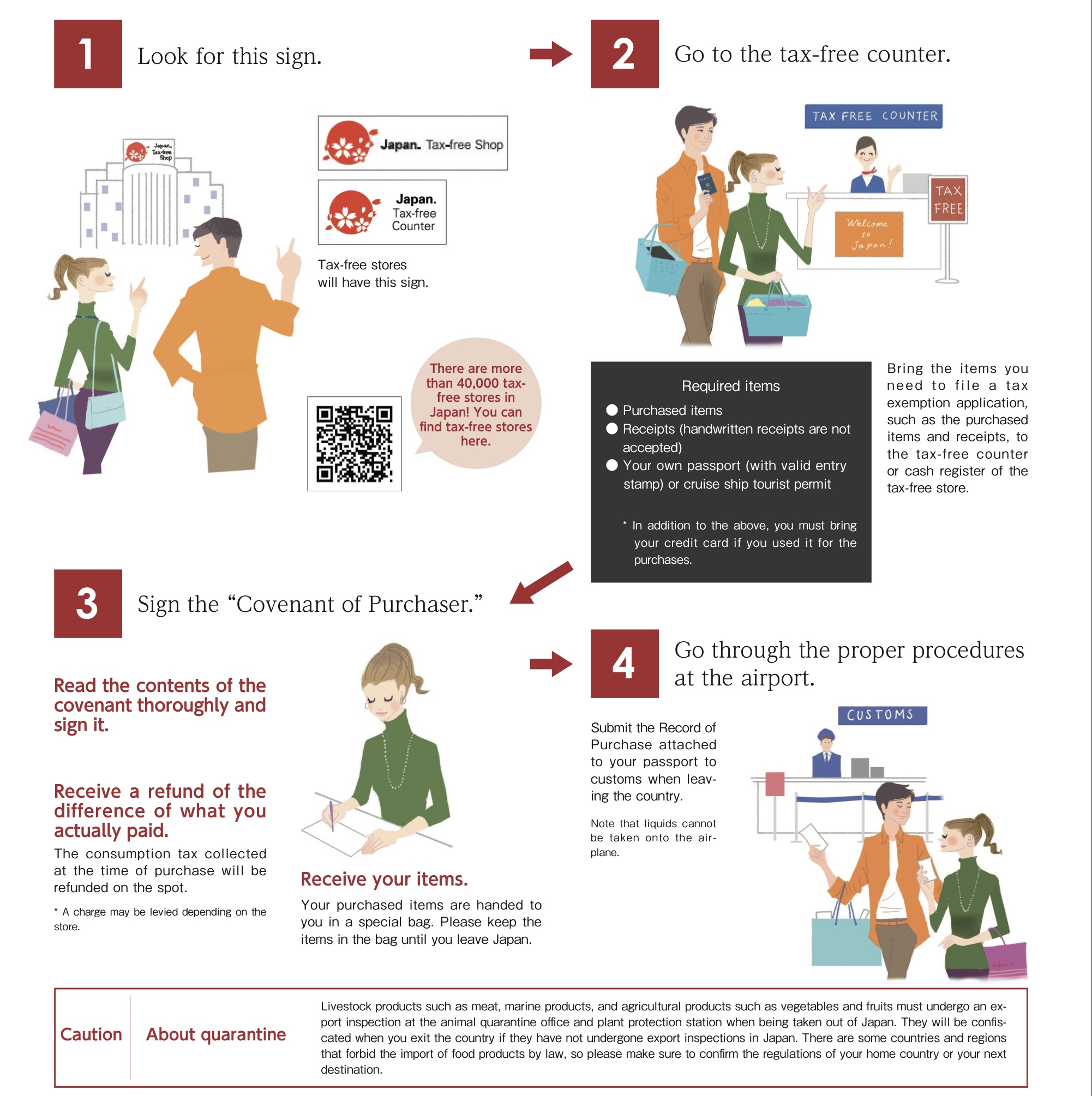

Step 1: Submit your Passport. A passport is necessary in order to fill out the duty-free paperwork. When you arrive at the duty-free counter you will be asked to present your passport. In the case that you have purchased your products at the register and are coming to the center to reclaim sales tax, you will need to present your passport as well as the sales receipt for your purchase.

TaxFree Shopping in Japan How to Shop and Get Your Japan Tax Refund! LIVE JAPAN travel guide

You can combine general goods and consumable goods for tax-free shopping. Tax-free purchase amount: the total purchase amount at the same store in a single day must be between 5,000 yen and 500,000 yen (without tax). Conditions: special packaging required, cannot be used in Japan, must be taken out of Japan within 30 days after purchase. We.

So funktioniert TaxFree in Japan Asienspiegel

Firstly, tax-free products in Japan refer to items purchased by non-Japanese residents for personal use and to be taken out of the country. General goods include home appliances, bags, clothes, handicrafts, watches, jewelry, and other reusable goods. Consumable goods include food, fruits, cosmetics, beverages, medicines, and other items that.

Cómo Funciona el Tax Free en Japón ⇒ 【¡Guía!】 ⛩️

Tax-free shopping in Japan refers to the 10% sales/consumption tax, also known as VAT, which can be claimed by foreign travelers, or found at tax-free stores dispersed throughout Japan. More and more stores are offering tax-free items given the rise of tourists shopping in Japan.

Tax Free in Giappone ecco come funziona lo shopping Ohayo!

Tax-exempt goods can be classified as consumables—food and beverages, cosmetics, medicines, batteries, cigarettes, and the like—and everything else. Generally, for consumables, the total spending amount should be from 5,001-500,000 yen (before tax) to qualify for a tax exemption, while general items should cost 10,001 yen or more (before tax).

5 TaxFree Shopping Facts All About Japan

1. What is Tax-Free Shopping Shopping in Japan is a blast! Make sure you bring an extra suitcase! Most countries have a law that states that companies have to levy a sales tax on their products and services in order to collect tax revenue. Companies and shops charge this sales tax or consumption tax on top of their actual product price.

Cómo Funciona el Tax Free en Japón ⇒ 【¡Guía!】 ⛩️

Required Documentation Applicant's passport, etc. Tax-free Product Categories General Items Total for purchases made at the same store in one day: ¥5,000 or more (tax excluded) Home appliances and cameras Clothing Bags/shoes Souvenirs Watches/accessories

TaxFree in Japan wird noch attraktiver Asienspiegel

Tax exemption in Japan basically applies to all items, from general items such as home appliances, accessories, and shoes, to consumable items such as alcohol, food, cosmetics, cigarettes, and medicines. Tax is exempt only under certain conditions.See below for information about the current tax exemption in Japan. POINT1

TaxFree Shopping in Japan The LowDown Tokyo Cheapo

Tax-Free Shopping Visitors to Japan are eligible for tax exemption on many consumer goods. The process of receiving your tax back can vary from store to store. Learn More Tipping Tipping is not practiced in Japan. In fact, it can cause discomfort and confusion if you do. A service charge is generally added on to the final bill in restaurants.

Cómo Funciona el Tax Free en Japón ⇒ 【¡Guía!】 ⛩️

Since the end of November 2015, the minimum amount to enjoy tax-free goods is ¥5,000 (~US$33.38). If all conditions are met, the 8% and soon 10% from October 2019 (rate of the Japanese VAT) will be deducted like a discount from the total amount when checking-out at the cashier.

Compras, tax free y aduanas en Japón

The number of tax-free shops in Japan is increasing every year, and there are now more than 40,000 tax-free shops according to the Japan Tourism Agency's announcement for the previous 6 months. Please see the page below for a list of major tax-free stores: Find Tax-Free Shops Have more questions? Contact us Was this article helpful? Yes No

Japan Guide Very easy & convenient, Japan Tax free Shops

Table of Contents How much is consumption tax in Japan? What stores offer Tax-Free shopping in Japan? What about Duty-Free shopping? Who can NOT shop Tax-Free in Japan? How does Tax-Free shopping work? Is there a minimum purchase amount to shop Tax-Free? Precautions when buying consumables Tax-Free Tax-Free shopping process FAQ Tax-Free Coupons

Japan's Tax Exemption About TaxFree Shopping Japan. Taxfree Shop

A seaweed shop in the basement of a department store Consumption tax and tax-free shopping. Consumption tax in Japan, known in other countries as VAT, GST or sales tax, is a flat 10 percent on all items except food, drinks and newspaper subscriptions for which it is 8 percent (not including alcoholic drinks and dining out).Shops are required to show price tags that include the tax; however.

Make your money go tax free! Soft Landing Tokyo

The Procedure for Tax-Free Shopping in Japan. There are two different types of tax exemption procedures depending on malls or stores. Type A: At the time of purchasing, submit your passport and pay for your goods with the tax already deducted. Type B: Pay the full price, including the consumption tax, and head to the tax-free counter on the.

Como ganhar desconto nas compras no Japão? (TAX FREE) YouTube

When you buy certain articles in Japan, prices include consumption tax (8% or 10%). However, as a special measure, tourists from overseas are exempt from paying consumption tax if they follow certain procedures at licensed tax-free agencies (such as department stores, home appliance stores, discount stores and others) on condition that they are taken out of Japan.

[Tipps] TaxFree in Japan Günstig einkaufen! WanderWeib

1 What products are tax-free? From October 1, 2014, additional products are added to the tax-exemption products at tax-free program participating stores. This includes food, medicines and cosmetics. *There are some restrictions and conditions depending on the type of products for tax-exemption purchase. 1. Consumables (foods, drinks, medicines.