Solved Table of Future Value Factors Instructions To use

Estimate the total future value of an initial investment of any kind. Future value calculator with cash flow (periodic additions or withdrawals, inflows or outflows).. Future value of annuity example table; Initial Value Rate of Return Number of Years Yearly Payment Present Value; $100,000: 14%: 1-$5,000: $109,000: $100,000: 14%: 2-$5,000.

Future Value Tables Double Entry Bookkeeping

Future Value of a Single Amount Table | AccountingCoach.com n = the number of time periods in which the interest is compounded i = the interest rate per period with the interest added and compounded at the end of each period Learn how to calculate the future value of a single amount.

Future Value of a Single Amount Finance Strategists

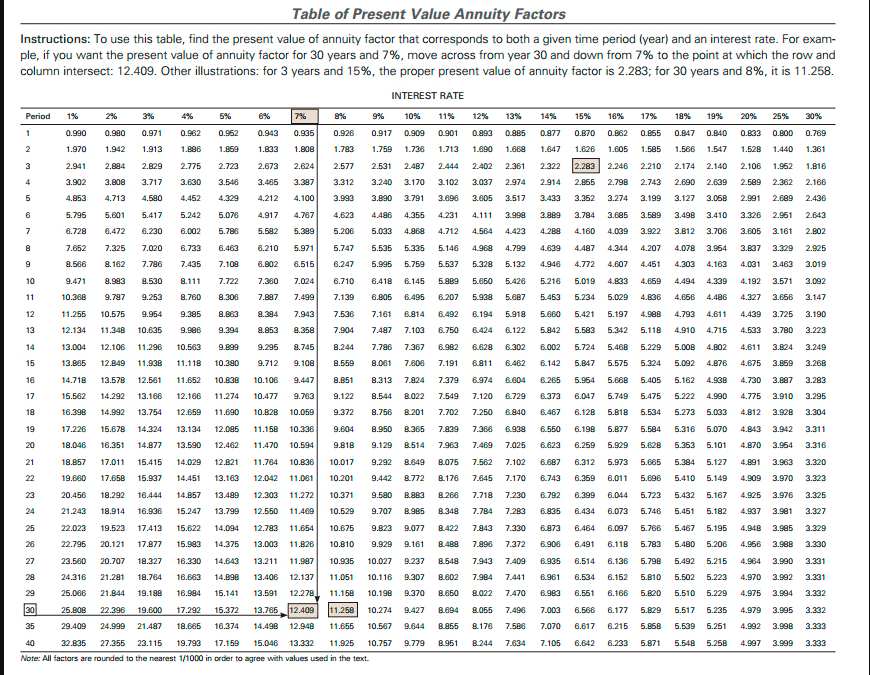

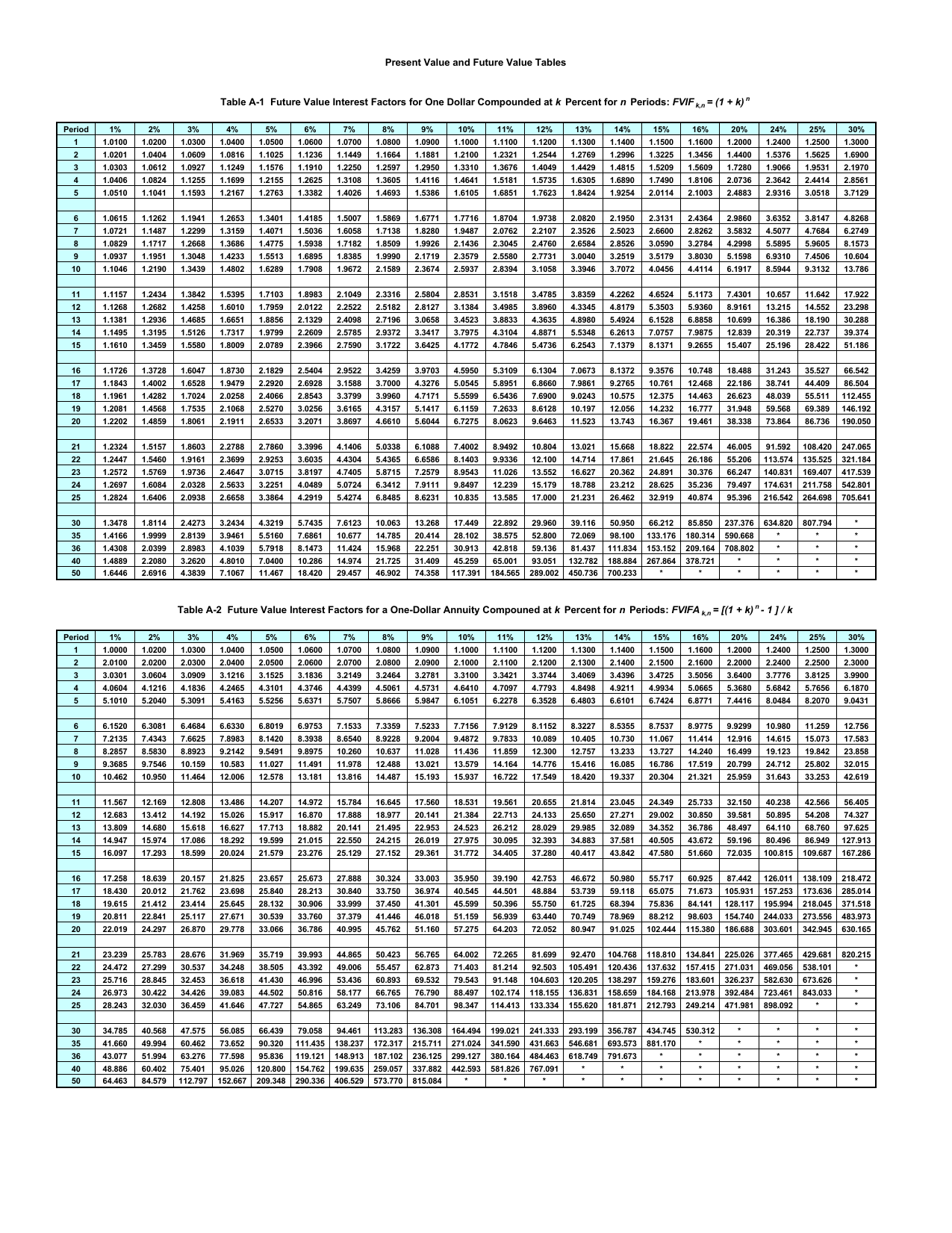

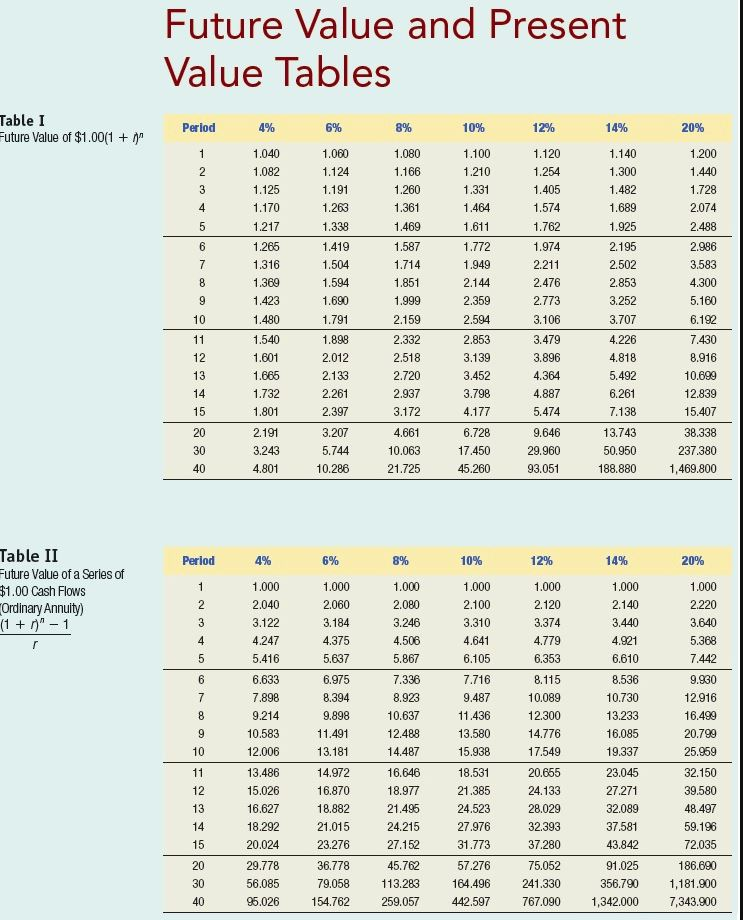

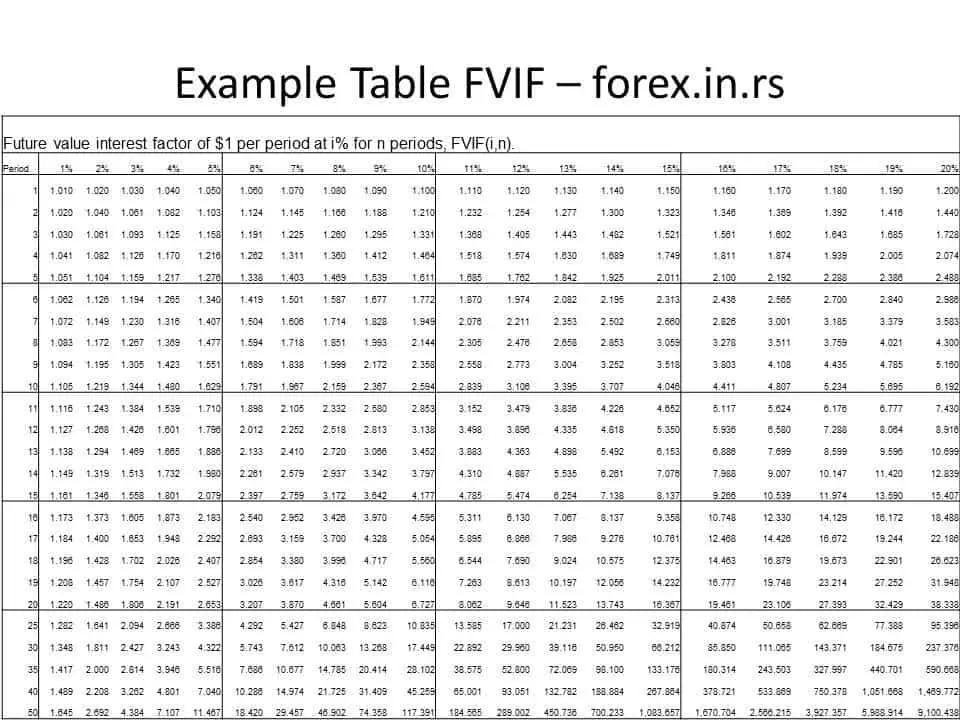

The purpose of the future value tables or FV tables is to carry out future value calculations without the use of a financial calculator. They provide the value at the end of period n of 1 received now at a discount rate of i%. The future value formula is: FV = PV x (1 + i)n

futurevaluetables

With four of the above five components in-hand, the financial calculator can easily determine the missing factor. But you can also calculate future value (FV) and present value (PV) by hand. For.

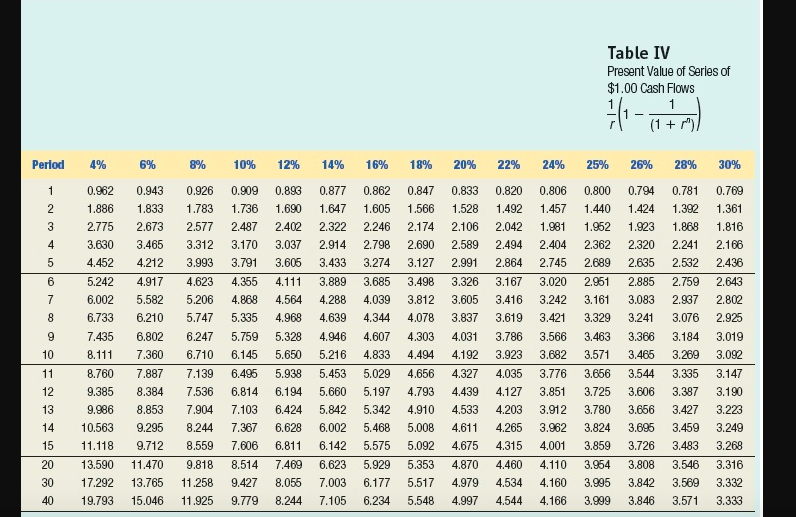

Solved Future Value and Present Value Tables Table I Future

The FV of 1 table provides the future amounts at compound interest for a single amount of 1.000 at various interest rates. These factors should make the future calculations a bit simpler than calculations using exponents.

(PDF) Present Value and Future Value Tables Table A1 Future Value Interest Factors for One

1 single cash flows. Formula: FV = (1 + k)^n Period (n) / per cent (k) 1% 1.0100 1.0201 1.0303 1.0406 1.0510 1.0615 1.0721 1.0829 1.0937 1.1046 1.1157 1.1268 1.1381 1.1495 1.1610 1.1726 1.1843 1.1961 1.2081 1.2202 1.2324 1.2447 1.2572 1.2697 1.2824 2%

Future Value Factors AccountingCoach

Monthly Compounding = 12x. Daily Compounding = 365x. For example, if you decided to invest $100.00 at an interest rate of 10% - assuming a compounding frequency of 1 - the investment should be worth $110 by the end of one year. Future Value (FV) = $100 × (1 + 10%) ^ 1 = $110.00. However, if the interest compounds semi-annually, the.

Future Value Factor Forex Education

Future value (FV) is the value of a current asset at some point in the future based on an assumed growth rate. Investors are able to reasonably assume an investment's profit using the FV.

Present and Future Value Factors Tables Online Technical Discussion Groups—Wolfram Community

Future value calculator is a smart tool that allows you to quickly compute the value of any investment at a specific moment in the future. You need to know how to calculate the future value of money when making any kind of investment to make the right financial decision.

Solved Future Value and Present Value Tables Table 1 Future

The future value formula with compound interest looks like this: Future Value = PV (1 + Annual Interest Rate) Number of Years. Let's say Bob invests $1,000 for five years with an interest rate of 10%. This time, it's compounded annually. The future value of Bob's investment would be $1,610.51.

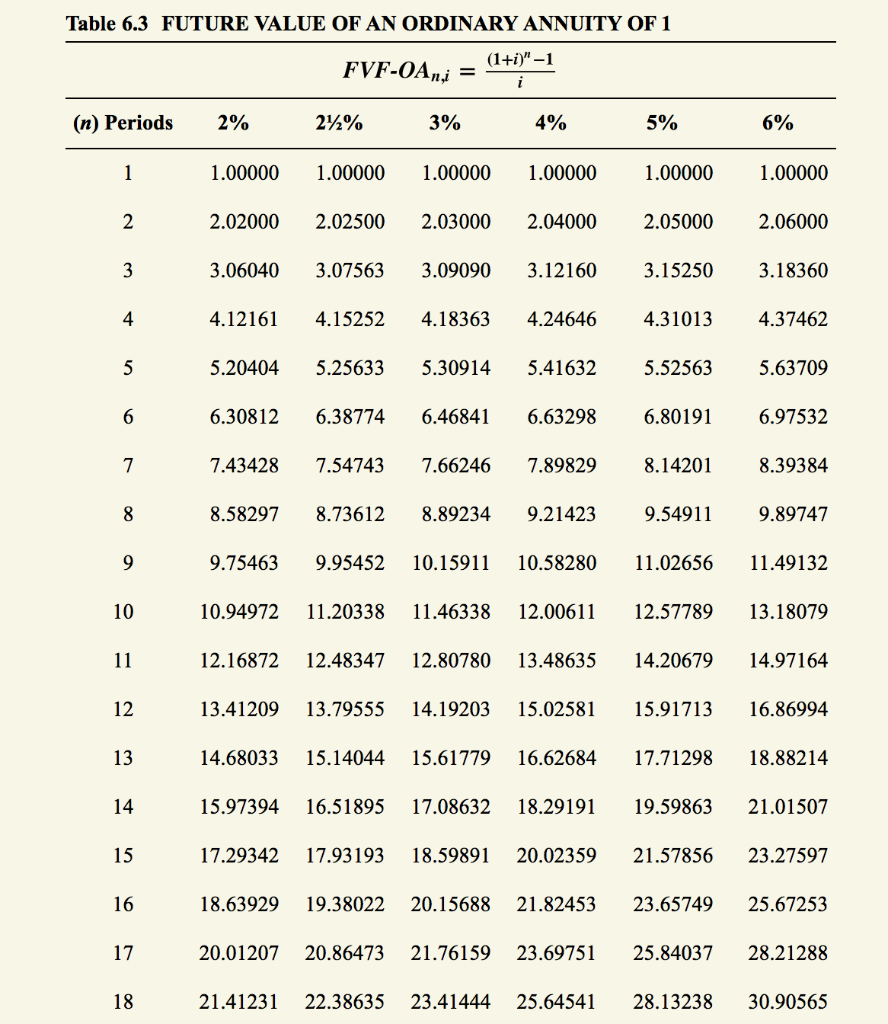

Solved Table 6.3 FUTURE VALUE OF AN ORDINARY ANNUITY OF 1

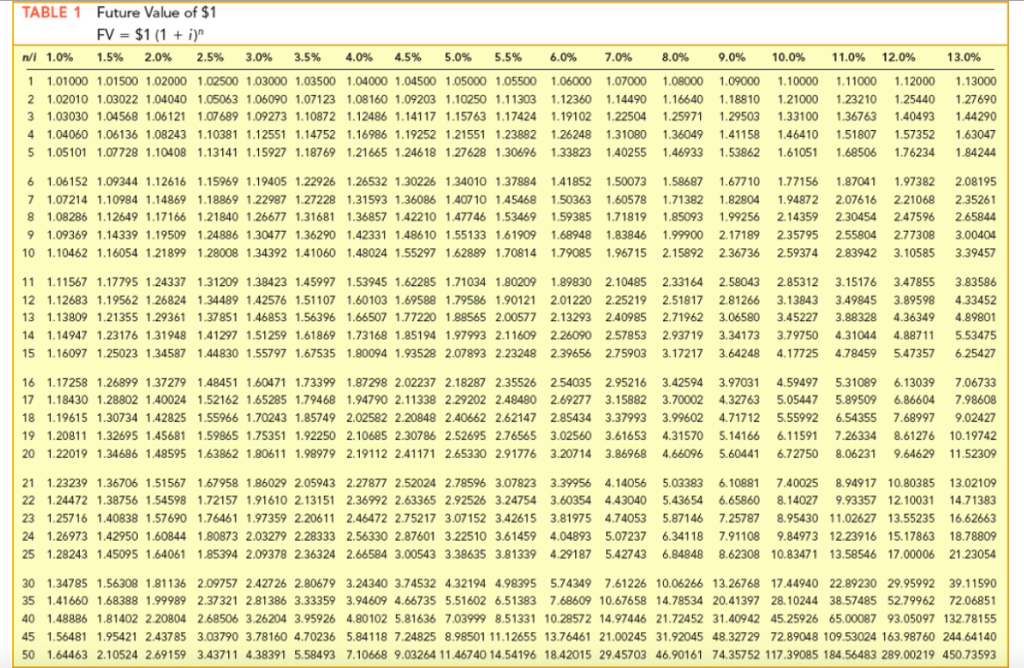

TABLE 1 Future Value of $1 FV $1 (1 i ) n + n/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 1 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 1.04000 1.04500 1.05000 1.05500 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.13000

Solved TABLE 1 Future Value of 1 FV=1 (1 + i)n 1.5 n/i

The future value calculator can be used to calculate the future value (FV) of an investment with given inputs of compounding periods (N), interest/yield rate (I/Y), starting amount, and periodic deposit/annuity payment per period (PMT). Results Future Value: $3,108.93 Schedule

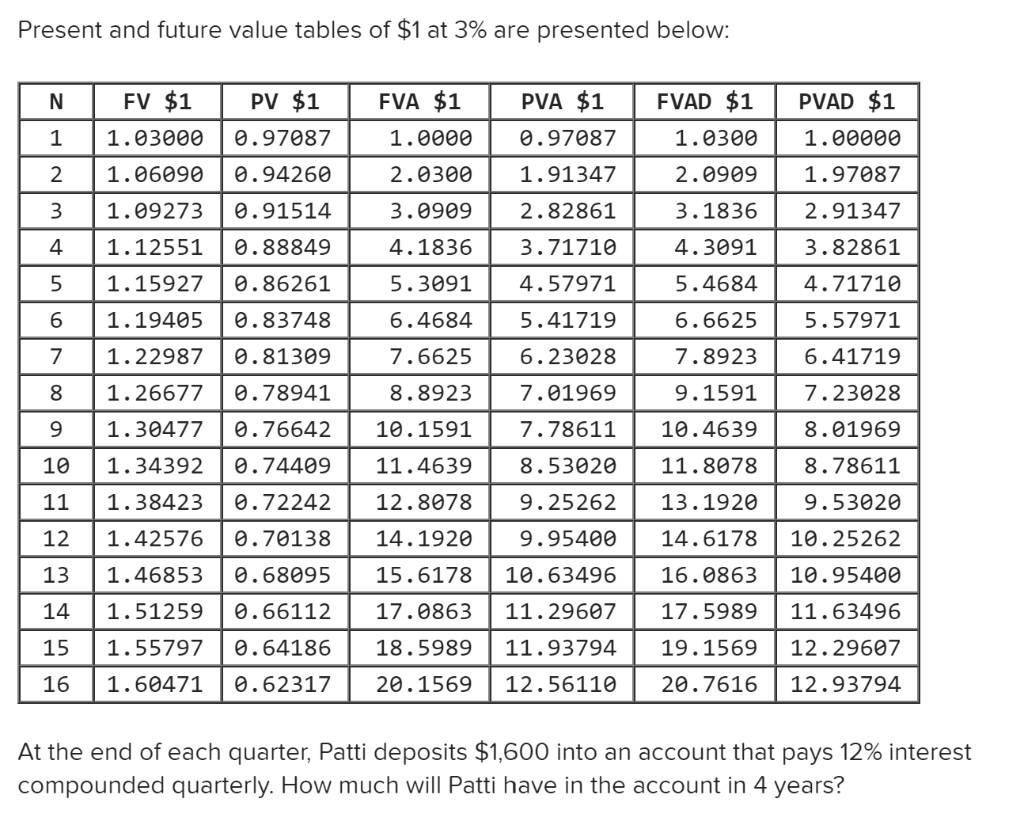

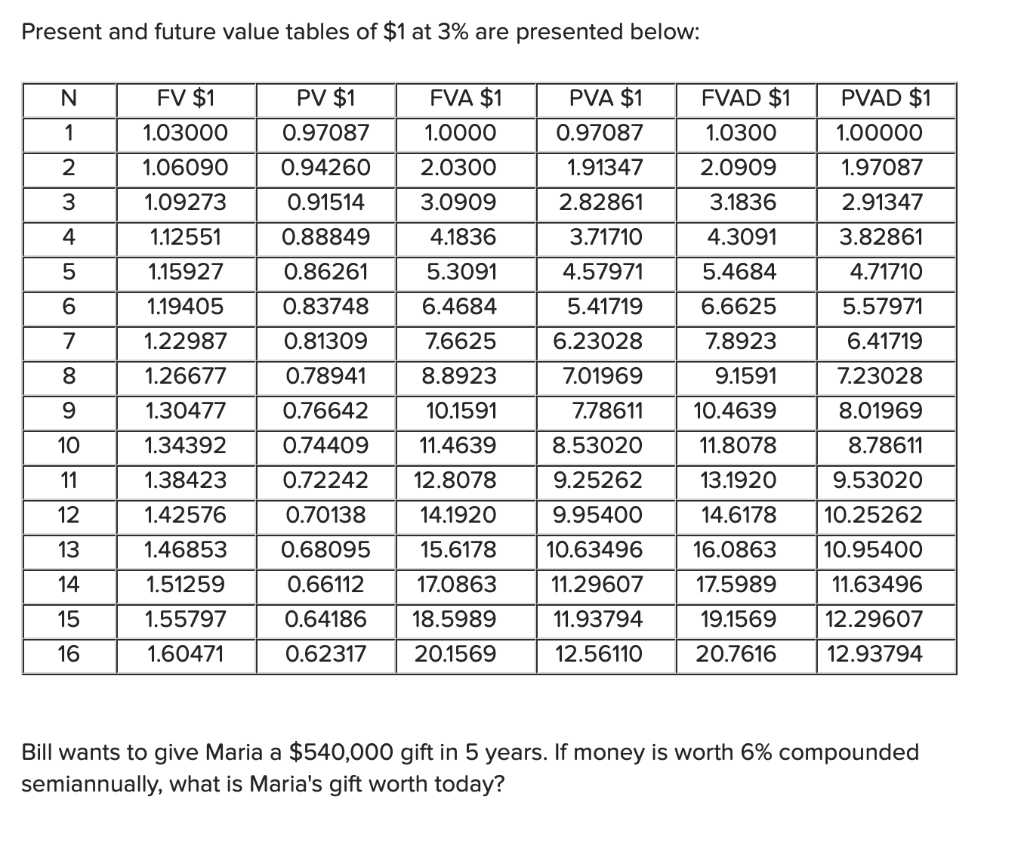

Solved Present and future value tables of 1 at 3 are

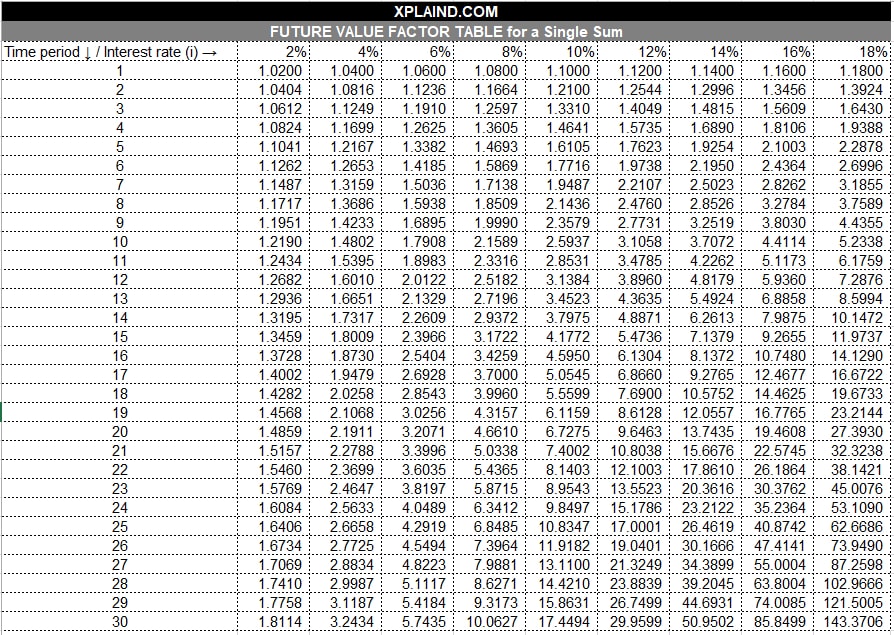

Future Value Tables Formula: FV = (1 + i)n n / i 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1 1.0100 1.0200 1.0300 1.0400 1.0500 1.0600 1.0700 1.0800 1.0900 1.

future value tables.pdf Present Value Insurance Free 30day Trial Scribd

Answer: Print Table Future Value of $1 ( FVIF) F V = $ 1 ( 1 + i) n n / i 3.00% 3.25% 3.50% 10 1.34392 1.37689 1.41060 11 1.38423 1.42164 1.45997 12 1.42576 1.46785 1.51107

Solved Present and future value tables of 1 at 3 are

Calculate a simple future value of a present sum of money using the future value formula FV=PV(1+i)ⁿ. The future value return of a present value investment amount.. See the Future Value of a Dollar calculator to create a table of FVIF values. Number of Years Use whole numbers or decimals for partial periods such as months, so for 7 years.

Future Value Factor Table Formula Example

TABLE 1 Future Value of $1 FV $1 (1 + i )n n/i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 1 1.01000 1.01500 1.02000 1.02500 1.03000 1.03500 1.04000 1.04500 1.05000 1.05500 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.20000